Dividend Value Builder Newsletter

Tactical Asset Allocation Versus Strategic Asset Allocation

We’re going to explore the pros and cons of a tactical asset allocation versus a strategic asset allocation. Studies show that close to 90% of investment returns are determined by portfolio asset allocation. Yet many investors focus on choosing individual investments and put minimal thought into the importance of asset allocation.

Don’t get me wrong. I spend a great deal of time looking for individual undervalued investment opportunities. Finding investments with a margin of safety is an important aspect of value investing. However choosing your asset allocation is the most underrated concept in value investing.

Simply stated, asset allocation is how you divide your assets between different investment classes or groups. A strategic asset allocation is the most commonly promoted in the current financial culture.

What is a Strategic Asset Allocation?

A strategic asset allocation model is one in which the mix of portfolio assets is fixed according to the individual investor’s profile. The percentage of assets allocated to cash, bonds, stocks, real estate, etc. is set according to the investor’s goals and strategies, current financial status, and risk tolerance.

The key supposition is the asset allocation remains fixed unless the investor’s profile changes. In other words, if the investor determines that 60% equities, 30% bonds, and 10% cash is the target asset allocation, then that will be the target unless there is a change in the investor’s goals and strategies, current financial status, or risk tolerance.

Advantages of a Strategic Asset Allocation Model

There are two main advantages of a Strategic Asset Allocation:

1. Relatively easy to maintain.

2. Tailored to the individual investor’s profile.

With a strategic asset allocation the investor can invest on “auto pilot”. After the initial analysis that determines the investor’s goals and strategies, financial status, and risk tolerance, little effort is needed to maintain the set asset allocation.

Disadvantages of a Strategic Asset Allocation Model

The main disadvantage of a strategic asset allocation model is that it only considers the investor’s profile. The other half of the equation, the non-investor factors, are ignored. The most important non-investor factor, the valuation of the opportunities available, is completely ignored by a strategic asset allocation model.

What is Tactical Asset Allocation?

Tactical asset allocation is an active asset allocation strategy that includes management of risk through portfolio rebalancing to a flexible asset allocation target.

Different valuation levels should require a different asset allocation of your capital. One of the most important concepts in value investing is to be careful or prudent about the price you pay. It’s not possible to do this without changing your allocation to asset categories (i.e. stock, bonds, cash) after assets make large price swings.

A tactical asset allocation provides the value investor a dynamic asset allocation strategy that adjusts to favorable and unfavorable valuations. Instead of a strict fixed percentage (strategic asset allocation) you have greater flexibility because you choose from a range based on current conditions.

“It’s essential for investment success that we recognize the condition of the market and decide on our actions accordingly.”

Howard Marks

The value oriented investor wants to allocate more to assets that were priced the farthest below its real or intrinsic value. Assets which are priced above their real worth can be completely avoided or minimized.

As an example, consider your asset allocation during the first decade of this century. Should your portfolio have held the same percentage of equities when valuations were sky high (i.e. 2000) compared to after they fell 57% in 2008-09? Of course not.

The purpose of a tactical asset allocation strategy is to increase risk adjusted returns as compared to a fixed or strategic asset allocation. The idea is to be more aggressive (invest more money) in lower risk undervalued assets, and be more conservative (invest less money) in higher risk overvalued assets.

We know from history that when asset prices are lower than their fundamental or intrinsic value they provide higher than average rates of return in the long run. When asset prices are expensive compared to their fundamental value they provide lower than average rates of return in the long run.

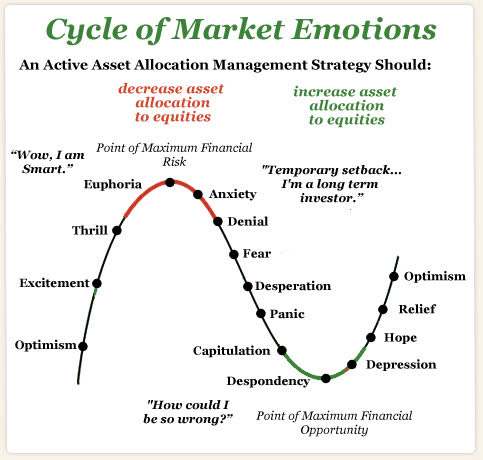

Adopting a tactical asset allocation is one of my five portfolio risk management strategies. Investors can take advantage of volatility if they understand market emotions affect asset prices. When focusing on value, investors can look for opportunities in assets that are experiencing extreme pessimism, and look to take profits in assets that are experiencing a buying euphoria.

Advantages of a Tactical Asset Allocation

We live in the best era in history for investing. Technology and competition has reduced transaction costs. This allows investors to move from overvalued assets to undervalued assets with relative ease. It no longer makes sense to maintain positions in grossly overvalued assets.

A tactical asset allocation is an effective means to limit your portfolio risk. During time periods when investment assets are overvalued (high risk, low expected returns) a tactical asset allocation allows an investor to “hide” in cash. Cash can help protect your portfolio in bear markets. You cannot buy low and sell high by allocating money to assets that are expensive.

At the same time, having cash available when market valuations are low provides investors the ability to take advantage of favorable opportunities. Think about how much better you would do if you bought more when prices are low and less when prices are unfavorable. Many investors do just the opposite and wonder why their long term returns are so poor.

You should expect volatility and take advantage of it. Make it a point to understand how volatility affects performance. here are a few posts that will help you understand why and how you can control your portfolio losses:

34 Investment Strategies and Rules To Make You a Better Investor

Minimize Large Portfolio Drawdowns

Invest With Confidence in Less Time - Manage Your Portfolio Without Behavioral Errors