Dividend Value Builder Newsletter

– Discover, Compare, and Evaluate Dividend Stocks Without Emotional Bias –

(Intrinsic Value Analysis For Over 300 Stocks)

What is a Drawdown?

Drawdown Definition

The simplest definition is “the act, process, or result of depleting” (TheFreeDictionary).

A drawdown is a measurement of decline from an assets peak value to its lowest point over a period of time. The drawdown is usually expressed as a percentage from top to bottom. It can be measured on any asset including individual stocks or sectors. However, it is most valuable as a measurement of portfolio risk.

A large drawdown is the biggest risk in investing. Drawdowns destroy investment capital and often shatter an investor’s confidence. Sometimes it even causes investors to lose their motivation to continue investing.

The reason drawdowns are the biggest risk in investing is because you lose your investment capital. Most investors don’t realize how devastating a large portfolio drawdown is to their long term returns. It’s better to understand this concept through education rather than experience! I will demonstrate the importance of avoiding drawdowns.

How a Drawdown Robs Your Future

A drawdown can destroy your future. It robs you of the investment capital you once had to grow your portfolio. Keeping every drawdown within your risk parameters is more important than high returns. This is why:

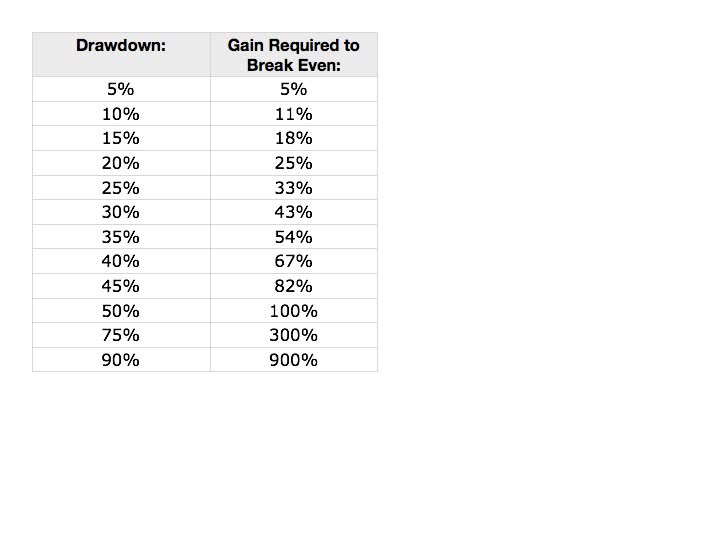

Notice how the required gain to break even grows exponentially the greater the drawdown. This is because you are losing the investment capital that could be making you money when your investments are rising.

It takes an 11% gain to recover a 10% loss. Not a problem.

It takes a 25% gain to recover a 20% loss. Harder.

It takes a 43% gain to recover a 30% loss. Problem.

It takes a 67% gain to recover a 40% loss. Big problem.

It takes a 100% gain to recover a 50% loss. Devastating.

It takes a 300% gain to recover a 75% loss. Catastrophic.

It takes a 900% gain to recover a 90% loss. You’re Starting Over.

Five years of 15% annual gains followed by a 50% loss leaves you back where you started 6 years earlier. Nine years of 10% annual gains followed by a 57% loss (2007-09 bear market) puts you at break even for the entire decade.

How to Avoid Drawdowns

In general, investors are too greedy when prices are high. Our emotions cause us to want to be part of the crowd. We compare our returns to the indices. We listen to our friends and colleagues who only boast when they are doing well.

Related Reading: 5 Portfolio Risk Management Strategies

When valuations are high, the probability of a large drawdown is high, yet we become careless and fixate on high returns. Instead, as valuations become excessive, we should be increasingly concerned about preserving capital for the time when valuations offer probabilities for success that are heavily in our favor.

Summary

Your biggest risk in investing is a large portfolio drawdown because you lose your investment capital. Portfolio management is as much about controlling losses as it is making money.

We have no influence on the direction or volatility of stock prices. Therefore it makes sense to focus on what you can control:

I use a formula or calculation to guide my long term asset allocation target:

Related Reading: Maximum Drawdown and the Concept of Probable Maximum Loss

Minimize Large Portfolio Drawdowns

Invest With Confidence in Less Time - Manage Your Portfolio Without Behavioral Errors