Dividend Value Builder Newsletter

Selling a Stock: Good Reasons and Common Mistakes

There are good reasons and common mistakes made by value investors when selling a stock. We put a lot of emphasis on investment decisions , especially the buy side. But the sell side can make the difference between success and failure.

We’re going to consider 3 reasons for selling a stock and examine two common mistakes made by value investors:

3 Reasons For Selling a Stock

1. Lack of Margin of Safety

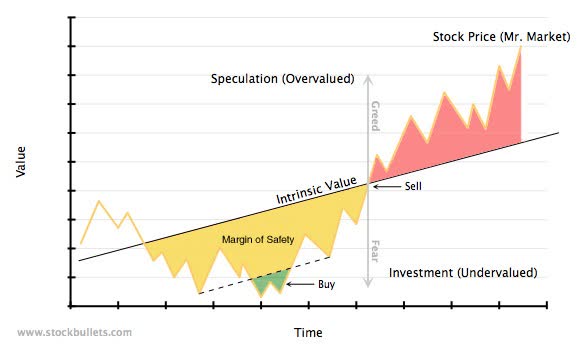

The foundation of value investing is owning investments that are priced with a margin of safety. I want to own stocks that put the odds of winning heavily in my favor. If the current price rises to the point it can no longer be owned with a margin of safety, the stock should be sold.

2. 5% Rule

The total value of any stock position should not exceed 5% of a portfolio. Company specific risk can be nearly eliminated with diversification. If you allow single stock positions to become too large you are taking risk you will not be compensated for.

The 5% rule is especially important if you work for the company. Why should anyone risk their job and retirement on any one company?

3. Fundamentals Change

Sometimes the fundamentals of a company change after purchasing the stock. If the result of the changes is that you no longer have a margin of safety at the current price, the stock should be sold. Selling the stock would also make sense if the fundamental changes meant other stock investments were a better value.

Common Mistakes When Selling a Stock

1. Loss Aversion Bias

Selling a stock at a loss is difficult for most of us because we have a loss aversion bias. Studies show people fear the negative effects of a loss twice as much as they enjoy the positive effects of an equal gain.

Investors have a tendency to be too nearsighted and make poor long term investment decisions because of short term loss aversion. It is common to want to break even on an investment. This may cause an investor to hold a stock even when they believe that it should be sold.

Example of Loss Aversion

Let’s say Paul purchases a stock for $100 and three months later decides to sell the stock due to a fundamental change in the company’s outlook. The price of the stock is now $97. Like most of us, Paul doesn’t want to take a loss so he decides he will wait until the stock reaches $100 so he can break even and avoid a loss.

Let’s look at Paul’s risk/reward ratio and see if it makes sense. His potential reward for holding the stock is only $3 because he has decided to sell at $100. Paul has decided to risk $97 for the potential of making $3 more than he can receive today. Risk aversion bias has caused Paul to make a poor risk/reward decision.

2. Selling a Stock Because the Price Has Fallen

A frequently asked questions is: Should an investor sell a stock after it drops a given amount below the price paid? I know many people believe in using stop loss orders and/or simply can’t stand the pain of a falling price. But a value investor should never sell a stock because the price has fallen.

If the price falls because something has fundamentally changed then you should reevaluate whether the investment is a good value at the current price. If not, then you would want to sell. If nothing has fundamentally changed why would you want to sell simply because it was “on sale”’? You should consider buying more not less!

Selling a Stock and Portfolio Rebalancing

Here is an illustration of the thought process a value investor should favor. Both valuation and portfolio rebalancing should be a part of buying and selling decisions:

Let’s say you have Asset A, which is a basket of stocks that will do well if we have rising inflation; and Asset B, which is a basket of stocks that will do well if we have falling inflation. If an investor believes the probability of each outcome is 50/50 he may choose to put 50% of the portfolio in Asset A and 50% in Asset B.

Let’s say rising inflation causes the value of Asset A to double and Asset B to fall 50%. Now asset A is 75% of the portfolio and Asset B is 25% of the portfolio. In other words, without rebalancing Asset A is 3 times as large as Asset B.

The value investor should assess the probability of the outcomes before rebalancing the portfolio. Let’s say the investor again believes that there is a 50% chance of inflation rising and a 50% chance of inflation falling. In such a case the investor would need to rebalance by selling some of Asset A (which had doubled) and buying more of Asset B (which is priced 50% less than the original purchase).

When the fundamental or intrinsic value of an asset has not changed, rebalancing forces you to buy more assets that are bargains and own less of assets that are expensive. For the value investor, rebalancing is a superior risk management tool compared to selling a stock just because the price has fallen.

Buying and Selling a Stock

Mentally prepare yourself for buying and selling a stock like you would consumer items. The further an item is priced below its real value the more you would be apt to buy! Think of investing the same way. Value investors will lower asset allocations to investments that are expensive and increase asset allocations to assets that are priced below their real valuation.

If you have done your research and understand the valuation of the company, the price you paid for the stock should not have an affect on your buy or sell decision. It is the current value compared to the price today that matters.

Don’t let loss aversion bias torpedo your investment returns. Forget about what you paid when selling a stock. What you paid for an asset has no bearing on the future price. Ask yourself; would this asset be worth buying now at today’s price? If not, sell it now.

When analyzing my portfolio I look at each individual asset and ask myself; is the current price an excellent value, does it provide a margin of safety? If not, I will sell it. If it does, I maintain my position and consider buying more anytime the price drops.

Once you own an asset the price paid should not enter into your buying and selling decisions. When selling a stock, it’s the value and price today that matters!

Related Reading:

Investing Principles Fundamental to Successful Outcomes

Minimize Large Portfolio Drawdowns

Invest With Confidence in Less Time - Manage Your Portfolio Without Behavioral Errors